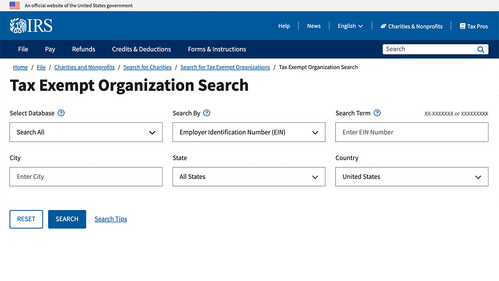

In order to complete the "Tax Info" section of your Dashboard, you'll need to provide an electronic copy of either your:

501(c)(3) Determination Letter

OR

EIN Verification Letter

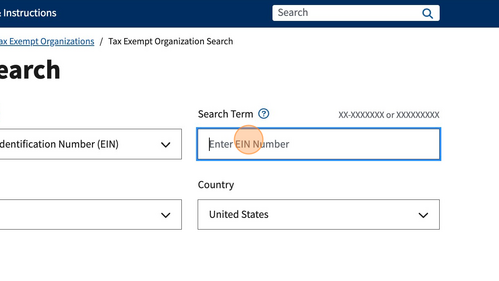

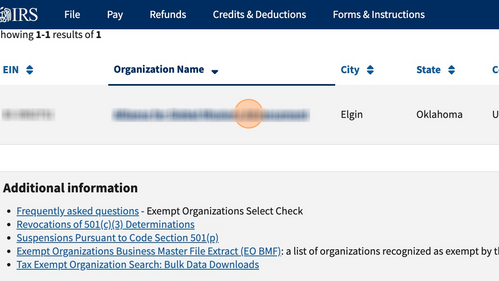

How to search for a 501(c)(3) letter

3.

Click on your organization's name

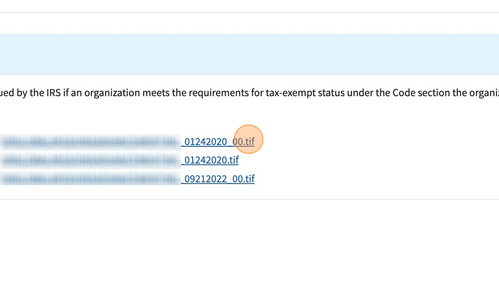

4.

Click on a link in the "Determination Letter" section

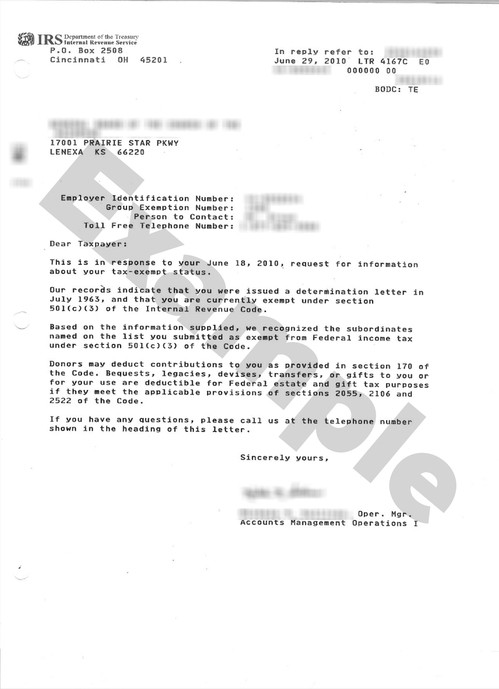

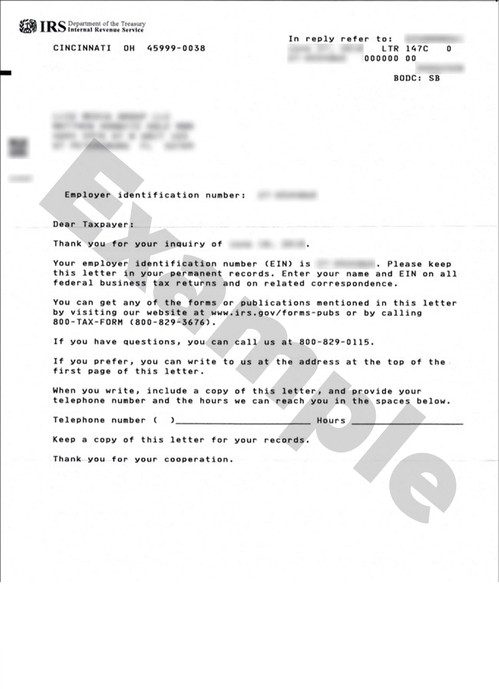

How To Request An EIN Verification Letter

To request a copy of your EIN Confirmation Letter (also called a 147C Letter), you'll need to call the IRS directly at 1-800-829-4933 between 7:00 AM – 7:00 PM EST. Then:

1.

Press "1" for English

2.

Press "1" for Employer Identification Numbers

3.

Press "3" for “If you already have an EIN, but you can’t remember it..."

4.

Request a copy of your 147C Letter

The IRS representative will then probably ask you some identity verification questions, and if you are can receive your EIN Letter by fax.

If you do not have a fax machine, you can sign-up for a free trial with an online fax service like efax, and then just cancel it once you have received your EIN Confirmation Letter.

If you do not have a fax machine, you can sign-up for a free trial with an online fax service like efax, and then just cancel it once you have received your EIN Confirmation Letter.